Published on Livewire 16/3/2018 (Original Article Here) – Romano Sala Tenna (Katana Asset Management – an Australian Fund Manager)

Historically, this time of the year is a terrific time to buy shares in NAB, Westpac and ANZ. None better to be exact. For nearly 2 decades, buying these 3 banks at the beginning of March and selling them at the end of April has been a winning trade.

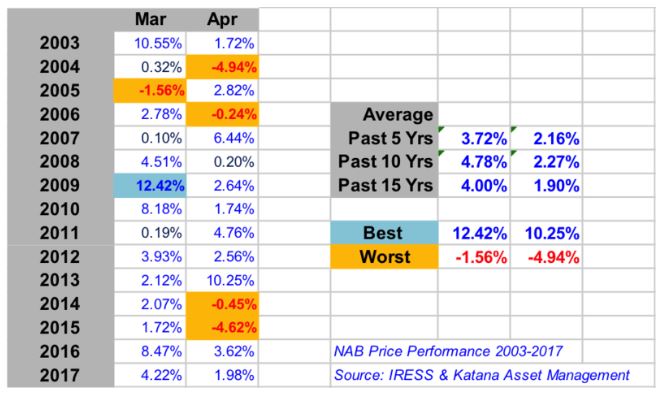

Take NAB for example; over the past 15 years, NAB has only declined once in March, by a modest 1.56% in 2005. On every other occasion, the NAB price has risen, and not just slightly – but by an average of 4.0%. Similarly, April has been a distinctly positive month with an average increase of around 2% over most timeframes.

Combining the 2 months means that on average NAB has risen by approximately 6% over March/April since 2003.

Will 2018 see a rerun of this trend?

However, at the time of writing this piece, NAB is down approximately 2.5% for the month and hence is heading towards its worst result in nearly 2 decades.

And the reasons are obvious enough. Clearly sentiment towards this sector is being tested by the dual regulatory reviews currently underway and in particular the bank royal commission. At the heart of these reviews is really the size of banking sector profits.

This is a dangerous development in public sector interference, and has the potential to have wide-ranging ramifications across industry generally. What we are effectively saying through the bank Royal Commission is that we are unhappy that a group of companies has competed so well that they have dominated much of the competition. Effectively we are penalising a group of companies for competing too well! This is a perilous precedent.

Rather than interfering, what the Government and regulators should be laser-focussed on is ‘how do we create more competition’ not how do we penalise companies that have competed well.

There are many ways that competition could be created in the banking sector: quasi public-private partnerships, relaxing licences for foreign banks, wholesale funding and tax breaks for new entrants, allocating venture capital for technology disruptors etc. But these all take skill, time and effort and it is easier and more popular to instead bash the banks.

To some investors, this examination may seem too political or too qualitative to warrant a part in any investment analysis. But unfortunately this is precisely the point: the #1 determinant of bank share price performance has now become the impact of the regulators.

The madness of bureaucracy

Net interest margin, credit growth, bad debt provisions and economic performance are all important; but the #1 factor that is driving bank share prices, and that will drive bank share prices over the foreseeable future, is the impact of the bureaucrats.

To determine whether history will repeat this year, you need to form a view on that issue.

And as Isaac Newton famously quipped after losing his life savings on the stock market: “I can calculate the motion of heavenly bodies, but not the madness of people.’