Published on Livewire 02/06/2022 (Original Article Here) – Romano Sala Tenna

A sense of needing to hit the ball out of the park to keep growing their wealth is a dominant theme I’ve observed in my many discussions with family offices and high net worth individuals over the past two decades.

There is an innate belief that their capital will not meaningfully expand unless they’re taking large, concentrated risks. Most of this is deeply seated in their DNA. Often, it’s focus and determination to create something out of nothing despite all of the advice and likelihood of succeeding that has ultimately created their success. Their DNA makes them great risk-takers, visionaries, builders, and creators. On top of that, the inherent wiring is emotionally confirmed by the fact that despite the risks, despite the odds, despite what everyone said – it worked out!

But really, once the capital base is established, there needs to be a profound change in the mindset. That’s because the likelihood of generating meaningful wealth from scratch a second time is statistically remote in the extreme. And perhaps more importantly, there is no need to try.

Enter the power of compounding. The single most important concept in finance. A concept that everyone understands, but very few truly embrace.

The change of mindset alluded to above is part of what I refer to as a “hub and spoke” approach, which I discuss further below. But first, the role compounding plays in growing wealth needs to be emphasised.

Compounding produces ‘obscene’ returns

Following are some simple, real-world examples of the power of compounding.

The ASX has returned an average of 10.8% per annum (dividends and capital growth) over the past 146 years. That’s good but not spectacular.

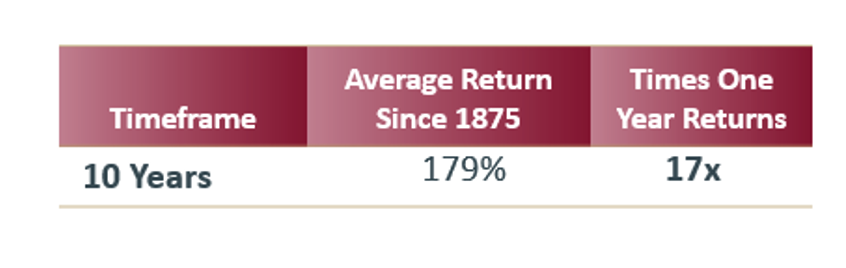

But if you had invested in the ASX index, turned off your screen and came back 10 years later, then on average your return would have been 179%. Through the power of compounding, over a 10-year period, you have managed to generate the equivalent of 17 years’ worth of single-year returns. That’s a better return but still not spectacular.

Let’s now assume that you invested for 15 years in the index instead of 10. What is the impact of that additional five years? Simply by turning off your screen for those extra years, the returns would be 366% on average. This is the equivalent of 34 years’ worth of one-year returns. The extra years have generated the equivalent of a further 17 one-year returns. That’s fantastic – but still not spectacular.

Extending this investment timeframe by another five years, investing for 20 years instead of 15, the average return over the past 146 years would be 678%. But rather extraordinarily, this is the equivalent of 63 one-year returns. These additional years would see you gain the equivalent of an extra 29 one-year returns.

If a family office was to invest $100 million in the ASX index and compound it for 20 years, it would be worth $778 million. With a high level of probability and without lifting a finger. And of course, the returns compound and accelerate further each successive year.

As we see below, adding a few smarts around the construction of the hub can create an even higher level of performance.

The “hub and spoke”

Picking up this point from earlier, taking wealth accumulation to the next level requires a change of mindset in viewing wealth accumulation through the lens of a hub and spoke model.

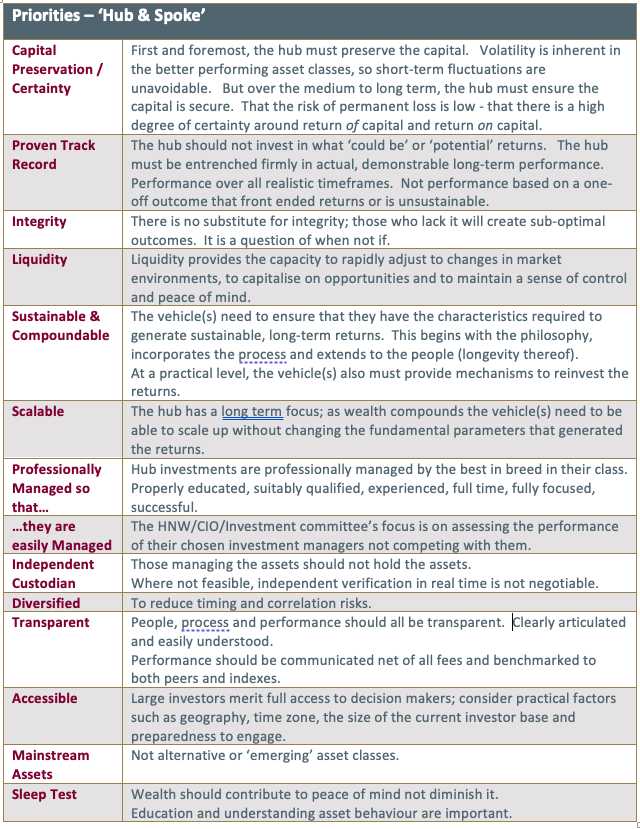

The hub is where the bulk of the capital should reside, which should exhibit a host of characteristics that are compatible or ideal for compounding. Most importantly, these characteristics should protect the capital, with growing it in a safe but robust fashion the next priority. I outline some key characteristics of the ‘hub’ below:

The spokes are smaller, higher-touch investments that may ‘hit the ball out of the park’, but by definition are much higher risk. How risky? Even if you had the “crazy-brave” confidence to take a large position, it would not make sense to do so. Spokes also enable the founder to continue to exercise their passion, vision, skill, and insights. But without jeopardising the family’s material wealth.

Anyone who is ‘wealthy’ should at least consider a model of this type. The proportion devoted to the hub versus spokes will vary based on risk profile, objectives, and life circumstances. But the thinking behind this approach is essential for long term wealth protection and accumulation.

Characteristics of a “Hub”

Everyone will view and prioritise these characteristics differently. The following framework makes sense to me.

Characteristics of Be-“Spoke” investments

Such investments and speculations have the potential to return multiples on their initial investment. They’re also opportunities for a founder to explore and live out their interests and passions, and in some instances use their unique skill set to attempt to once again create something extraordinary.

But the trade-off is that they entail greater risk to capital or return on capital. They commonly are high-touch positions that require active management or at the very least more detailed analysis and ongoing monitoring.

Such investments are also likely to exhibit several or more of the following characteristics:

- Minimal track record

- Illiquid

- Not scalable

- Concentrated

- Opaque or complex

- Fringe assets

- Sub-optimal ownership structure.

I would suggest that aspects such as integrity, professionalism and access to key decision-makers are non-negotiable even for be-spoke investments. Depending on your wiring, an investment that creates more than a little anxiety is (also) probably not worthwhile – and it’s not required. Time will throw up enough opportunities. All you need is patience.

Inter-generational wealth

The spokes or satellites play to the passions and skillset of the founder(s). They may include the “best “speculative opportunities that emerge for those with capital, profile and HNW networks.

But as the family office matures, history shows that the hub usually grows and the spokes dwindle.

The hub and spoke model changes the paradigm from doing to assessing. The hub evolves the family office from being an environment that focuses on generating returns to one that is pathologically centred on evaluating returns. Choosing between suitably qualified professional managers. If the CIO and team are able to identify an array of funds able to add genuine alpha, the impact is nothing short of astonishing.

There are many good funds and professional managers. As one example, the Katana Australian Equity Fund has returned 2.77% per annum net of fees above the index for nearly 17 years (past performance is no guarantee of future performance).

By returning an extra 2.77% per annum net of fees, an investment would return the equivalent of 1,159% over 20 years. The extra 2.77% per annum when compounded over 20 years, would generate the equivalent of 107 one-year returns. By focussing on assessing returns rather than generating returns, a CIO is able to add an additional 42 one-year returns over just 20 years. That fits the definition of obscene.