Published on Livewire 1/4/2020 (Original Article Here) – Romano Sala Tenna (Katana Asset Management – an Australian Fund Manager)

From the March 23rd intra-day low of 4,429 to the current close, the ASX All Ordinaries index has rallied 19.4%. This begs the obvious question: is it time to go all in?

There are certainly some signs that this may well be the time. For example, the market is increasingly reacting positively to bad news; the breadth of stocks rallying have increased, volumes and volatility are both declining. Commentary is becoming less pessimistic. These are all indications that in the short term at least, sentiment has turned.

But most of these factors are secondary to the main drivers and so in effect they are really noise. Noise that distracts us from maintaining our focus on what is most important.

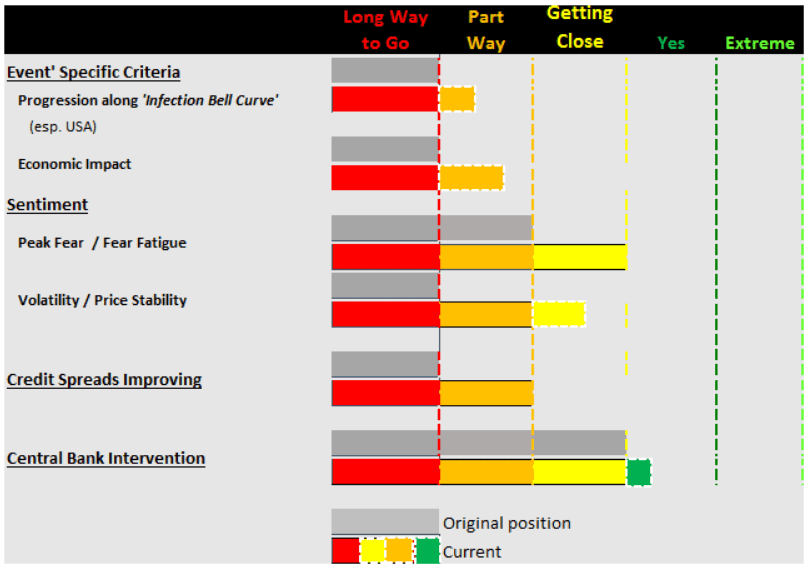

In our earlier piece, we were clear to identify what were the key factors that would drive a recovery, and then to map out progress against those factors. From a glance we can see (below) that we have made progress against all the important drivers. From the original position less than 2 weeks ago (in grey) we can see that ‘Fear’, ‘Volatility’ and ‘Credit Spreads’ in particular have all made significant progress.

However, the 2 most important drivers as we see them, still have some way to go. In particular, we are concerned that we have some way to go along the US Infections Bell Curve and hence being able to quantify the Economic Impact. Indeed, revised estimates are now pushing back the peak in US -infections to weeks 3 or 4 in April. Whilst that does not seem like a long time, we need to remember that infections grow exponentially not linearly.

There is a possibility that the Australian market may decouple from the US, given the positive progress being made here in combating the spread of Covid-19. But whilst this is a possibility, the probability is that as in every major dislocation, our market will follow the US more or less.

There is also the argument that markets are forward looking, and a degree of this pending escalation in the US has already been factored in. Whilst this is true, in our assessment we are likely to see some horrible images, headlines and statistics in the next 3 weeks.

For all investors, such imagery is tragic and distressing. These are human lives lost forever and suffering on a widespread scale. These are events that are hard to process emotionally and mentally. But we need to be awake to the impact that such images will have, which in all likelihood will lead to a 2nd wave of fear and panic.

There are still opportunities that we are very selectively sniping at present. Quality emerging companies that are trading 60% and more below their February prices. With the vagaries of percentages, a share price decline of 60% is equivalent to a gain of 150% from the current price in order to recover to the pre-existing level. This is a risk-reward we are happy to take on irrespective of the macro backdrop.

But on the whole, we are waiting to see how the next 1-3 weeks unfold in the US. As Howard Marks regularly reminds us, there are 2 risks in investing: the risk of losing your capital and the risk of missing an opportunity. I’ve experienced both risks too many times to remember, and the first one hurts a lot more than the second. Not to mention its permanent!