Published on LiveWire 16/08/2021 (Original Article Here, subscription required) – Romano Sala Tenna

This morning’s confirmation that Woodside is exploring a merger with BHP’s Petroleum assets is an extraordinary development. A development that even 12 months ago would have seemed unimaginable. But such is the speed with which shareholder activism and ESG is gaining prominence, considerations are progressing.

Whilst the petroleum assets are one of BHP’s 4 pillars, for Woodside the transaction is even more significant.

Based on the various media reports, BHP’s petroleum assets represent in the order of between 75-110% of Woodside’s current size.

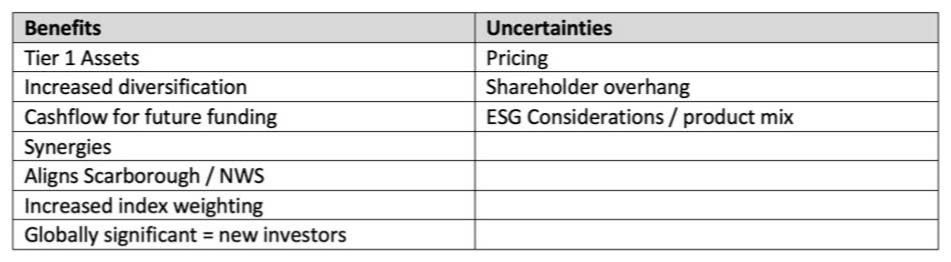

From Woodside’s perspective there are some things to like about the potential merger.

To begin with, the Gulf of Mexico assets are globally recognised tier 1 assets. Resources of this calibre rarely find their way to the market, let alone on ‘friendly’ terms. Bass Strait is past its best but is still a respectable asset, and the Atlantic projects, Scarborough and the North West Shelf are all quality LNG properties. And of course the substantial increase in the operational base increases diversification and reduces the reliance on any single asset.

Secondly, these assets are highly cash generative at current prices. On desktop projections, these properties are more than adequate to meet Woodside’s extensive capex requirements across Scarborough, Pluto 2 and Senegal. So this would remove the overhang of any future capital raisings, not to mention provide a substantial lift to profitability.

There are also some clear synergies from cost, management, marketing and funding perspectives. And of course the merger would remove a major road block and enable the re-alignment of interests in both the North West Shelf and Scarborough assets.

From an investor-demand perspective, there are also two positives. Firstly, the market capitalisation is likely to double in size, give or take. This dramatic increase in index weighting will require passive managers such as ETF’s, index funds and index huggers to dramatically increase their holdings in Woodside shares. And perhaps more importantly, the increased scale, quality and diversification of assets, will place Woodside firmly on the radar of international investors. Many of whom would not currently reside on the register.

So with some good things to like about the potential merger, how do we explain today’s 4.5% decline?! I think there are three things that the market may be concerned with.

Clearly the first of these is the uncertainty around pricing. Markets hate one thing above all else: uncertainty. We do know that on any historical metric, Woodside is trading at depressed levels. But we do not know whether they will be able to structure a transaction that similarly prices BHP’s petroleum assets.

Woodside is half pregnant and that is not a fun state for a listed company. Until management is able to clarify if a merger will occur and if so at what price, investors will be nervous.

The second issue we see is the inevitable shareholder overhang. We have no handle on what % of BHP shareholders would sell versus hold Woodside shares. But we do know that a percentage would sell, and when we are talking about issuing a billion new shares give or take, a ‘percentage’ can equate to a very large number. Yes, passive funds and international investors will soak up some of this stock. But in the interim I would not be surprised if hedge funds were shorting Woodside shares, expecting to cover their positions post any transaction.

Finally, and most significantly, the very reason that BHP is jettisoning these assets is weighing on the Woodside price. In the space of less than 12 months, ESG investing has gone from fringe to mainstream. Woodside shares are a whole lot less desirable than they were just 12 months ago.

And there is a more subtle issue at play with this transaction. LNG is a much cleaner burning fuel than coal or oil, and more discerning ESG advisers and investors realise that it is a necessary part of the transition to renewables. And possibly even a part of the long term solution, given the flexibility to turn gas generation on and off at the flick of a switch. But BHP’s assets are heavily weighted towards the production of crude oil, and that is likely to move Woodside’s ESG credentials one notch to the left.

In summary, we are only one day into this journey, so at Katana we need to be reticent about rushing to conclusions. But our current thinking is that a merger between Woodside and BHP’s petroleum assets, is both bad and good for Woodside shareholders – depending on your timeframe. Over the short to medium term, the uncertainty, shareholder overhang and heightened ESG issues are likely to weigh on the share price. Over the medium to longer term, these are tier one assets that will generate enormous free cashflow, profits and dividends. As ESG conscious investors head for the door, others will take their place. Over the longer term, the stock price is likely to re-rate.

Woodside management would be desperately disappointed that these discussions have leaked out. But now that they have, they need to move swiftly to bring some clarity and certainty to ‘if’ and ‘price’.