Published on Livewire 22/06/2023 (Original Article Here) – Ally Selby

Are markets climbing a wall of worry, or is this actually a new bull market? Katana’s Romano Sala Tenna isn’t so sure…

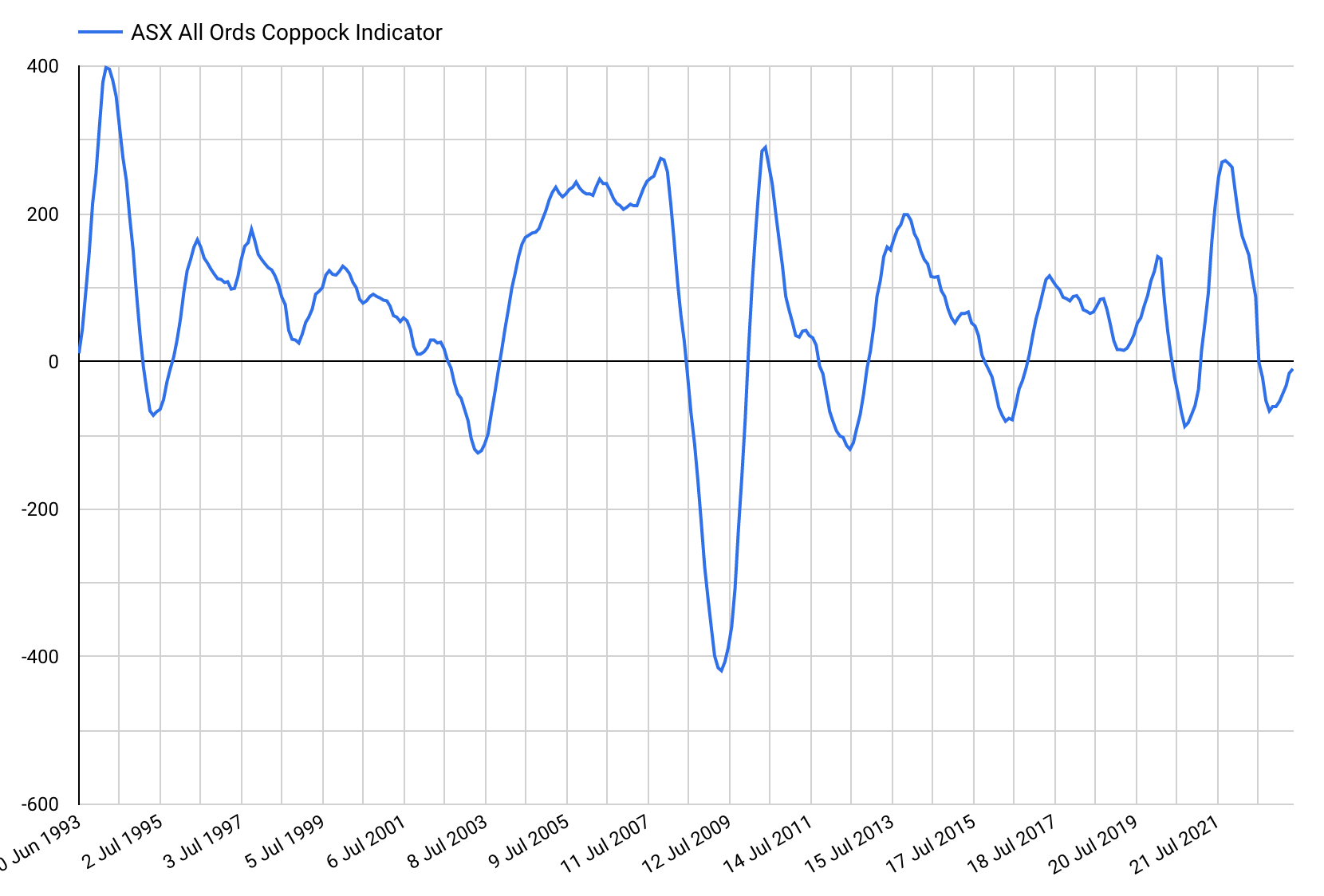

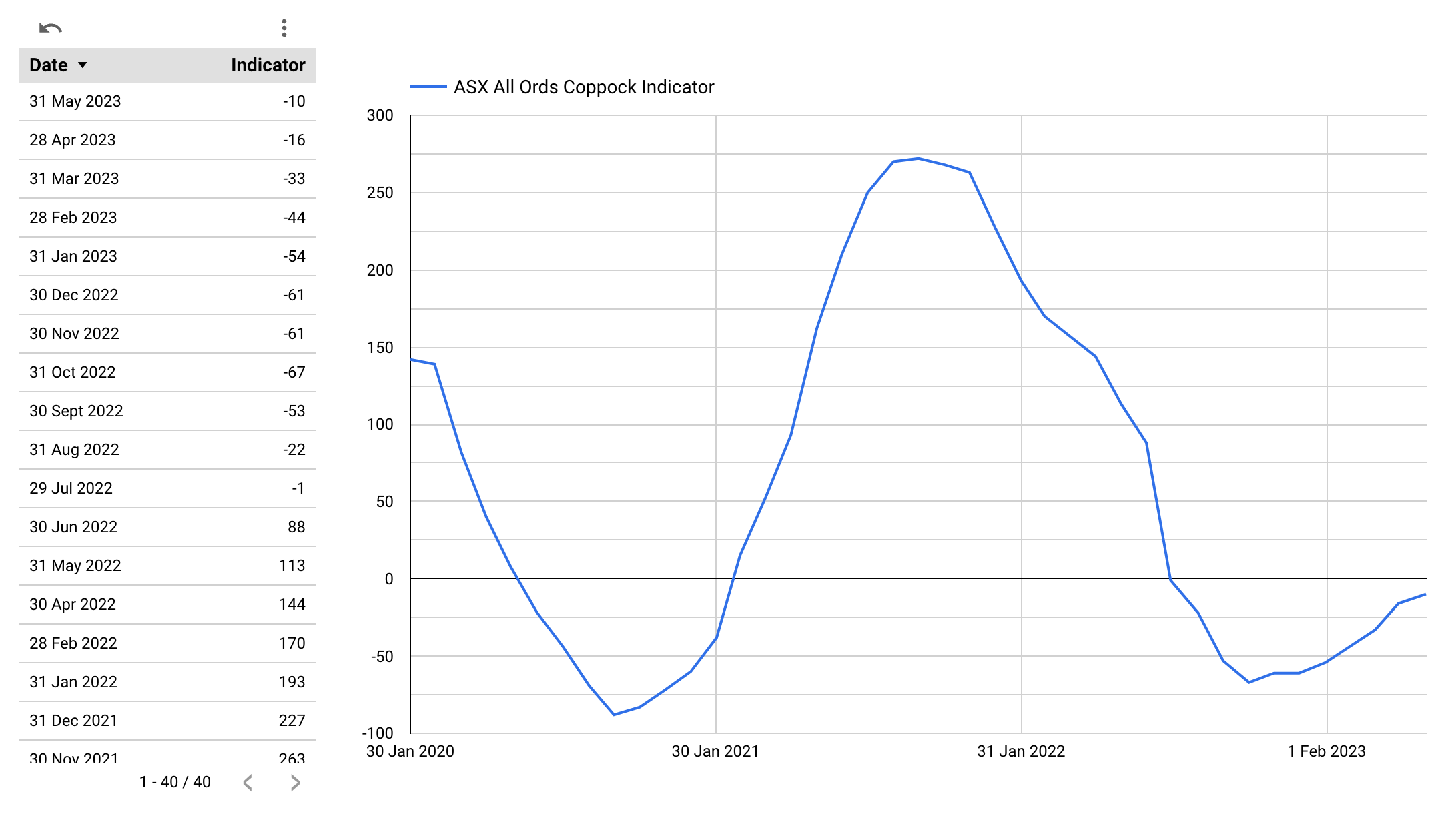

Of all the data points, signals and sentiment surveys that investors have at their perusal, there is one that has been notoriously accurate in its ability to signal when investors should buy or sell major stock indices – the Coppock Indicator.

It’s a pretty simple indicator that uses the month-end figure of an index. When the indicator moves into negative territory, it’s a signal to sell. When the indicator crosses into positive territory, it’s a signal to buy.

It’s not completely accurate and, as it is a momentum tracker, it often can be a few months early or a few months late, but if you take a look at the chart below, you can see times where it has been a pretty accurate indicator of times to buy and sell.

Recently, as seen above, it has just ticked up. And while it hasn’t crossed the threshold yet, it is certainly close.

For more clarity, I reached out to Katana Asset Management’s Romano Sala Tenna for his thoughts on what this could signal to investors.

Interestingly, Sala Tenna is currently sitting on nearly 40% cash, and while he is invested in many names you know and love – like Mineral Resources (ASX: MIN), CSL Limited (ASX: CSL), Beach Energy (ASX: BPT), Macquarie Group (ASX: MQG), Regis Resources (ASX: RRL), Allkem (ASX: AKE), IGO Limited (ASX: IGO) and several ETFs for offshore exposure – he isn’t finding much opportunity elsewhere.

In this wire, he shares what it would take for him to put that cash to work (and why the market may stay irrational longer than you can stay patient).

.jpg)

Markets lack clarity

Sala Tenna is adamant that corporate earnings have to decline “quite substantially”, despite markets continuing to climb a wall of worry.

This is because the cost of debt has increased dramatically, meaning companies borrowing costs are far higher. Further, while some inflationary supply bottlenecks may have eased, wage growth continues to remain sticky – which isn’t a good sign for businesses.

What’s more, consumers are tightening their purse strings, which will see sales slow. Margins often contract by a greater degree in this scenario as companies need to heavily discount stock or services to compete with their competitors.

“So corporate earnings have to decline,” Sala Tenna said.

In normal cycles, earnings decline and share prices fall with them. However, this cycle is different, Sala Tenna said. Since the beginning of the year, we’ve seen the world’s major indices soar higher, despite the outlook for earnings becoming increasingly challenging.

“The bears have no shares,” he said.

“Three weeks ago, a global fund manager survey showed that 60% are overweight cash and 60% are underweight US equities. Investors are already positioned for the downside. This could mean the path of least resistence is to the upside.”

Long story short, the fundamentals aren’t currently lining up with the technicals.

“We need to see which one is going to give. Either the technicals give, or the fundamentals give. I can’t see the fundamentals giving, so I think we’re due for another leg down at some point,” Sala Tenna said.

He believes much of the upswing we have witnessed in markets over the last month has been driven by short covering. However, once we see earnings data rollover, likely in the weeks ahead of the August reporting season, things aren’t going to be pretty.

“Other than the resources space, I just can’t see too many sectors that have a tailwind,” Sala Tenna said.

“But what if the fundamentals do give?” I asked. “It’s not like we haven’t seen a market like that before, 2020 and 2021 were prime examples.” After all, with NVIDIA (NASDAQ: NVDA) up 206% year to date, and Tesla (NASDAQ: TSLA) soaring 154%, that could truly be the case.

“Previously, where there was a break between fundamentals and sentiment was on a valuation or earnings basis. We saw companies trading at agressively higher earnings or revenue multiples. And that’s a normal cycle, you get that when people start making money in stocks,” Sala Tenna replied.

“This time is different. It’s been driven by an underlying contraction in earnings.”

Fear is a much more powerful emotion than greed, Sala Tenna added.

“When people start to look at some of the earnings numbers as they come through in the next few weeks, it’s not going to be about us all getting excited in a bull market and paying more for stocks. This is about the actual underlying earnings capitulating quite dramatically,” he said.

What are the indicators saying

The Coppock Indicator for the S&P 500 and the ASX All Ords have both turned up, and while neither have passed the threshold just yet, it is very rare, but not impossible, for the indicator to double dip lower.

So what does this mean for the market?

“The indicator is saying that around now is a good time to buy. But this is just one data point,” Sala Tenna said.

“There are a lot of data points that have been historically reliable that are in conflict at the moment. We don’t make decisions based on one data point, but it does build into our thinking and get us looking where it is in conflict with our base case… Right now, I just think people are too complacent.”

For instance, the VIX indicator is currently heading towards levels that indicate “profound complacency,” Sala Tenna explained.

“The VIX Indicator has been a great precursor of upheaval,” he said.

That’s not all…

“On the negative side, the median time to recession post the inversion of the 10-Year and 6-Month yield curve is 11 months and has been as high as 29 months and we are spot on 11 months at the moment,” Sala Tenna added.

“Another negative indicator is that we’ve seen years of overbuilding in China so the stimulus we are seeing now won’t have as much impact as it has in the past because it is becoming a services-orientated economy.

“But on the positive side, there is a strong ascending triangle in the S&P – so that’s actually a bullish signal breaking up through 4200. ETF open interest in put options is close to record highs, which could also be a positive indicator.”

What to expect this coming earnings season

Sala Tenna believes the run-up to reporting season in August will be far more important than earnings season itself.

“I think the confession season this year is going to be more important than it was last year, as companies start to get a line of sight on what their financials look like, especially through July,” he said.

“I think a lot of them are going to be minus 10% from where either previous guidance was or where the majority of analysts have the earnings set.”

In fact, Sala Tenna argues that surviving July will be investors’ toughest challenge yet. August, he argues, will still be important, but more so from an outlook statement perspective.

“Every year the outlook statements are important, but I think this year’s outlook statements will give the market some real clarity around the lag in monetary policy,” he said.

“I think it might be that watershed moment where the market finally sees the effects of that tightening flow through.”

Where Romano is invested

While Sala Tenna is adamant that investors shouldn’t sell all their equity holdings for cash, he does believe that with term deposits and bank accounts delivering around 5% to Australians, investors now have a “viable alternative”.

“There’s a lot to be said about getting +5% risk-free, particularly if you are getting the long-term average of 8% on the market but with a lot of risk,” he said.

“We’ve been saying for many years that it’s much better to be holding bank shares than have your money in the bank. I think that’s starting to pivot now.”

So where can investors find cash plus returns? Sala Tenna believes the answer lies within the ASX’s commodity-facing businesses.

“Most of our top 10 have electric vehicle (EV) exposure – we wouldn’t normally have that level of concentration, but its a reflection of the fact that we don’t want to own most stocks right now and these are actually the only businesses that are genuinely growing at the moment,” Sala Tenna said.

These include Mineral Resources (ASX: MIN), Allkem (ASX: AKE), Wesfarmers (ASX: WES), IGO (ASX: IGO), Pilbara Resources (ASX: PLS), Sandfire Resources (ASX: SFR), as well as the Global X Copper Miners ETF AUD (ASX: WIRE) – which provides the Katana team with exposure to 39 global copper companies.

Other than these EV-related businesses, Sala Tenna believes “defensive growth” stocks are an investor’s best bet, such as Dominos (ASX: DMP), of which the Katana team has recently reinitiated their position.

“I just think it has too much negativity factored into it right now,” Sala Tenna explained.

“It’s a very leveraged business model. It has such a high level of sales and a high cost base, but as it gets that cost inflation under control, it will spew out cash and it will flow through to the bottom line.”

Similarly, Sala Tenna would have been topping up his position in CSL (ASX: CSL) on the back of recent share price weakness if he didn’t already have a substantial position.

“They are still growing at 18%, but the street had gotten too optimistic. So they did what all good management teams do and didn’t wait till August,” he said.

“We haven’t been buying at the moment, we held our position, but in a normal situation we would have been topping it up.”

He’s also been playing the BetaShares NASDAQ 100 Currency Hedged ETF (ASX: HNDQ) for exposure to the rally we have seen in the world’s biggest tech companies since the beginning of the year.

“That’s in our top 20,” Sala Tenna said.

“From here, the traditional thinking is that if rates go up, tech goes down. That was true for a while, but then it became inverted because suddenly people realised that real tech, as opposed to speculative tech, is one of the few places where we have genuine earnings growth. And as we look forward, that’s one of the few places where people have the confidence to position themselves.”

Waiting to pounce: The stocks likely to receive the lion’s share of Romano’s dry powder

As mentioned earlier in this article, the team at Katana are currently sitting on a lot of cash – nearly 40% to be specific.

“It’s uncomfortable. We do not like being here. But every time we look at a company, we ask ourselves, ‘Would you want to own that with what it’s got in front of it over the next six months?’ And most of the time, the answer is no,” Sala Tenna said.

So where is the team hoping to put this dry powder to work? Glad you asked.

“If the world was to turn, there’s a lot of stocks that will recover and give you more return than the stocks we’re currently invested in,” Sala Tenna said.

“You could pick the eyes out of the retail sector – think JB Hi-Fi (ASX: JBH), Nick Scali (ASX: NCK), or Super Retail Group (ASX: SUL). If we see some changes, the best returns are going to come from the stocks we are avoiding today.”

But we are not there yet.

“The most difficult thing is the fact that we have to see some things play out. If we see earnings downgrades, for example, and the market remains robust, then that’s our signal to pivot,” Sala Tenna added.

“If we get some of these data points about earnings and outlook statements and the market doesn’t blink, then that means that sentiment is really strong, we are in a bull market and we do have to deploy capital.”