Published on Australian Financial Review (Original Article Here, subscription required) – Tom Richardson

Shares drifted sideways on Thursday as stronger-than-expected retail sales and jobs data suggested the Reserve Bank may need to lift interest rates again next Tuesday in an attempt to slow a still strong economy.

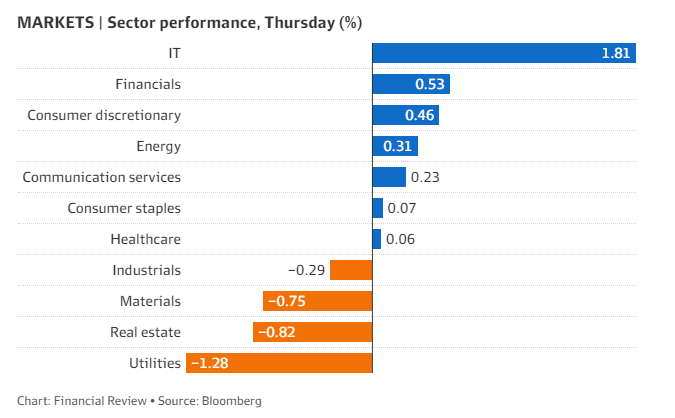

On the day the S&P/ASX 200 edged down 0.02 per cent or 1.6 points to 7194.9 points for its first loss in three sessions. A 1.8 per cent surge for the technology sector failed to offset falls in the materials, utilities, and real estate sectors.

Romano Sala Tenna, a portfolio manager at Katana Asset Management, said investors are sitting on their hands given the uncertainty over whether the RBA will lift interest rates another 25 basis points next week.

“I think we’re in a holding pattern at the moment,” Mr Sala Tenna said. “So there’s a bit of lull and most people are closing off their books [for financial year-end] and getting ready to reset for confession season in July and reporting season in August.”

Among the technology stocks, cloud accounting business Xero jumped 2.3 per cent to $117.28, with software logistics WiseTech adding 2.2 per cent to $79.35. The software duo has now advanced 67.3 per cent and 61.4 per cent respectively in 2023. Elsewhere, in technology data centre operator NextDC climbed 1.6 per cent to $12.49, with software group Technology One jumping 1.6 per cent to $15.69.

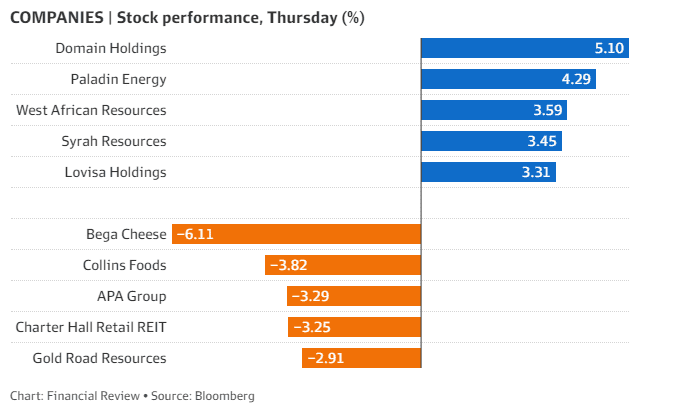

The second-best performing stock on the S&P/ASX 200 was $2 billion uranium miner Paladin, which added 4.3 per cent to 73¢,after telling the market on Wednesday that it’s exploring plans to raise capital via a potential syndicated debt facility. The best performer was Domain – majority owned by Nine, publisher of The Australian Financial Review – up 5.1 per cent to $3.71.

Other sectors, including real estate, utilities, and industrials, finished lower, with Mr Sala Tenna warning he expects more businesses to report worsening trading conditions over the first two months of financial 2024.

“I think we’re going to see some companies come to the market and admit ‘Look, we’re not where the market expects’, and we could have a few confessions,” he said. “I expect more than usual [confessions] based on our macro view, we know that monetary policy has a lag, so the big thing will be the outlook statements in August as well. There has to be some damage when interest rate rise as quickly as they have, the idea that everything is ok is not our view.”

Among the blue chips Commonwealth Bank closed up 0.5 per cent at $100.07, with healthcare giant CSL down 0.02 per cent to $278.30. While iron ore giant BHP Group lost 1.03 per cent to $44.95.

The gold price fell over the session to $US1911 an ounce at the closing bell, with gold giant Northern Star down 1.7 per cent to $12.12.

Benchmark US 10-year Treasuries added 3 basis points to 3.74 per cent.

Company, macro news

Data out of the Australian Bureau of Statistics on Thursday showed Australia’s jobs market remains robust despite the RBA’s historic pace of interest rate increases over the past year.

For May, total job vacancies were 431,600, down 9000 or 2 per cent from February 2023.

Private sector vacancies were 384,600, a decrease of 2.3 per cent from February 2023. Public sector vacancies were 47,000, an increase of 0.3 per cent from February 2023.

The result defined a still tight labour market, with just 1.2 people looking for a job for each vacancy. In August 2022, there were more job vacancies than people looking for jobs for the first time in Australia’s history, although the labour market has tightened slightly since.

“While job vacancies have fallen by around 10 per cent over the past year, they were still high – around 89 per cent higher in May 2023 than in February 2020, just before the start of the COVID-19 pandemic. This May saw businesses continuing to report difficulties in recruiting and retaining staff,” said Bjorn Jarvis ABS head of labour statistics.

In other macro news, retail sales in May increased 0.7 per cent seasonally adjusted, beating forecasts of 0.1 per cent growth. This follows a flat result in April.

“Retail turnover was supported by a rise in spending on food and eating out, combined with a boost in spending on discretionary goods,” Australian Bureau of Statistics head of retail statistics Ben Dorber said.

“This latest rise reflected some resilience in spending with consumers taking advantage of larger than usual promotional activity and sales events for May.”