Published on Livewire 6/2/2018 (Original Article Here) – Romano Sala Tenna (Katana Asset Management – an Australian Fund Manager)

The well-worn saying that the markets take the stairs up and the elevator down applies to the current correction more than most. Whilst it doesn’t provide any specific consolation, it should remind investors that the current panic is not new and in fact it is the way that we expect corrections to play out – ie swift and (hopefully) short.

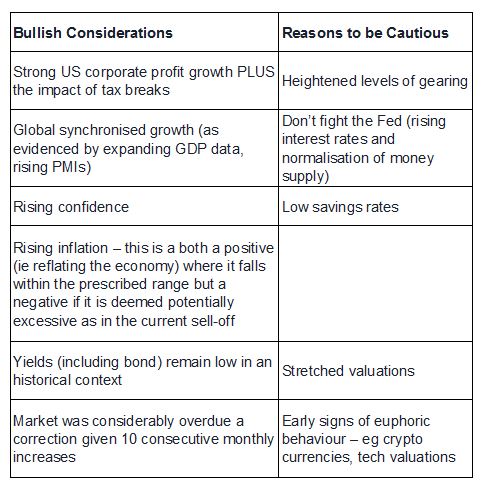

And as with every correction, there are a variety of factors to weigh up in determining the likely length and severity. We’ve simplistically attempted to outline some of these points below.

Sorting through these issues, 2 things come to the fore in our thinking.

As outlined above, the global economy (ie ‘main street’) is expanding and ordinarily rising earnings equate to rising stock prices.

And normally that would be the end of the story. However, the thing that concerns us most is the very same thing that drove the GFC – uncertainty around how much leverage is in the system. We know for example that margin lending has reached another record high in the US. And periods of low volatility and continuously appreciating indexes invariably lead to a reduced appreciation of risk which often manifests itself in higher gearing.

So whilst Main Street is expanding along nicely, Wall Street is where the issue lies.

In the more normal course of events we would expect the market to rally from around these levels give or take a couple of percent. And that’s the base case that we are positioning for.

However we are also watching for any signs that excessive gearing exists and hence may trip the market into a round of forced selling. If that occurs then the move can become systemic.