Whitepaper by Romano Sala Tenna (Originally published in ShareCafe – Source here)

Firstly let me be clear: whenever someone says ‘this stock is the next such and such’, it usually isn’t!

In fact I could count on both hands the number of times that analogy has turned out to be true.

So I would encourage you to start from a position of assuming that I am wrong, and make me ‘prove’ why this could be the next Credit Corp.

Secondly, in order to understand why ‘being the next Credit Corp’ is even worth aspiring to, we need to take a step back and understand just how good an investment it has been.

Credit Corp is a receivables management business. This is a fancy way of saying that they buy packages of ‘distressed’ debt at a fraction of the original cost, and then work to recover as much of that debt as they are able to.

Credit Corp listed on the Australian Stock Exchange on the 4th September, 2000. The issue price was 50 cents per share. A total of 11m shares were issued, raising a modest $5.5m. Over the following months the stock dropped to a low of 40c as the ‘sprinters’ departed, leaving the marathon runners to go the distance.

The prospectus forecast revenue for 2000 of $2.067m and a maiden profit as a listed entity of $519k. As it turns out both of these numbers were surpassed, and this has been a recurring theme throughout their history.

If we fast forward 16 and a bit years, we can see how extraordinarily successful the company has been:

| 2000

($m) |

2016 FY

($m) |

Change

(multiple) |

|

| Revenue | $2.07 | $226.7 | 108x |

| EBITDA | $0.97 | $71.2 | 73x |

| Net Profit After Tax | $0.52 | $45.9 | 88x |

| Market Capitalisation | $13.82 | $832.0 | 62X |

Source: Initial Prospectus and ASX Releases

And not surprisingly, this strong growth over such an extended period, has been reflected in the share price.

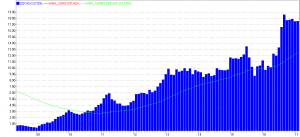

As we can see below, the share price reached an all-time high recently of $20.16 and in the past few months the price has consolidated around the $17 to $18.50 level. At the most recent close of $17.51, this represents a 1,651% return on investment.

Source:IRESS

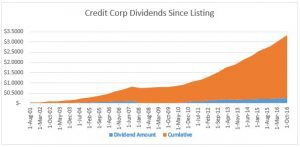

Even more impressively – if that’s possible – the capital growth component is only part of the story. Since listing, Credit Corp has paid a whopping $3.33 in dividends. That’s a 660% return on the initial entry price in dividends alone. If we include franking credits, that number grows to $4.76 per share.

Source: Katana Asset Management Data

Source: Katana Asset Management Data

Hopefully, that’s got your attention.

Next week, we’ll disclose the company that we believe could be the ‘Next Credit Corp’, and outline the case for you to critically assess.