Published on Livewire 18/5/2020 (Original Article Here) – Romano Sala Tenna (Katana Asset Management – an Australian Fund Manager)

(Ed’s Note: We asked two of our contributors who have strong views on banks to produce a bear versus bull case on this critical sector for income investors and SMSFs. Below, Romano Sala Tenna opines why ’tis the season to own bank stocks. Hit follow on the profile of Damien Klassen who will present the bear case exclusively for Livewire readers tomorrow).

What’s our medium to long-term outlook on Australian banks?

The challenge for investors is to maintain perspective, or as Warren Buffett puts it: ‘keep your head when everyone else is losing theirs.’ The chaos generated by Covid-19 is throwing up plenty of opportunities to practice this maxim, but perhaps none more so than in the banking sector.

However, we see the current risk-reward equation as being compelling.

To begin with, when the dust settles, investors will wake to the reality that the RBA has an official rate of 0.25% (at best) which means that deposit rates will be 1.25% (at best) which means that after inflation and tax, investors will receive a return of negative 1% (at best).

Under this scenario there will be an inevitable migration out of cash back into equities, in particular those with an above-average and ‘sustainable’ dividend yields. Reluctant at first, but inevitable in the end.

Whilst some could intimate that bank yields are not sustainable, we would argue that it is in fact the lack of dividends that is unsustainable. Whilst the majority of the investing community appears to be fixated upon the current half-yearly dividend, a simple review over any other timeframe would provide a very different picture.

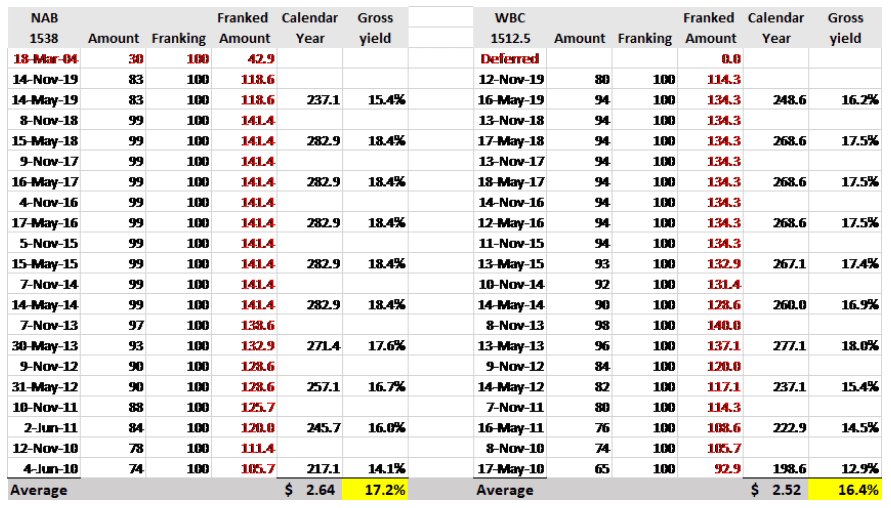

Consider, for example, dividends paid by NAB and Westpac over the past decade.

In summary, over the past 10 years, NAB has paid an average of $2.64 per annum including franking credits and Westpac $2.52 (ANZ not shown $2.24).

On the current share prices, this equates to grossed up yields of 17.2% and 16.4% respectively (ANZ 14.5%). History would clearly indicate that the present situation is the exception, not the norm.

And at the heart of this consistency is the core nature of banking. When the effects of Covid-19 pass– as they inevitably will – the population will still need to borrow money. The whole spectrum of lending from personal loans and mortgages right through to large scale business financing, will still be required. Borrowing money is as essential to a capitalist economy as oxygen is to human existence. Banks provide a core function that is irreplaceable.

Now some may suggest that the new breed of disruptors is impacting the banking system. But if you take a look under the hood of the vast majority of these ‘innovators’, you will find that a significant percentage if not all of their funding is originated with the major banks! And this is not surprising, because the major banks can borrow money cheaper than anyone else in the country.

This leads to the fourth reason we are positive on the medium-term outlook for the major banks, being their sustainable competitive advantages and barriers to entry. As we outlined already, this begins with their sheer size which enables them to borrow money – either through customer deposits or wholesale credit markets – at the lowest average cost. But in addition, the Big Four banks also enjoy the largest economies of scale, deepest IT spend, trusted (perhaps not loved) brands and extensive distribution footprints.

These are sizeable and significant barriers to entry, and go towards explaining why the four major banks have remained four for such a long period of time. Investors often go to great lengths to find monopolistic or oligopolistic industries, but in the banking sector it is in plain sight – and yet often missed.

Its perhaps not surprising therefore that the CEO of the countries’ largest mortgage broker, AFG, noted recently that the major banks were once again dominating market share in new originations.

As we often say internally, the short term is unknowable but the long term is inevitable. By this we mean that in the short term, sentiment rules the roost, but over the long term fundamentals drive share prices.

Whilst it is difficult to know precisely where the banks will move in the short term, we are confident that over the medium term and beyond they will be substantially higher due to the:

- Need for yield

- Long term track record of profitability and dividends

- Core nature of banking

- Competitive advantages and oligopolistic industry structure

What about record low rates and the economy?

It is clearly harder to hide bank margin in record low rates. With the official rate at 0.25% and mortgage rates now testing the 2% barrier, the net interest margin (NIM) has never been tighter. This is clearly a significant headwind. And with deposit rates on many accounts already at 0% (or negative when account fees are included), there is no scope to reduce them any further to increase the spread.

Whilst not sufficient to completely offset the tight rates, the banks do have a few levers to pull. To begin with they have been reducing the impact on margin by withholding a component of some of the recent rate cuts.

They have also been aggressively working the expense side (with mixed success). And of course, in simplistic terms record low rates should equate to record high lending volumes and record low defaults. Should rates persist at these levels for an extended period – as our base case suggests- this combination of record lending and low provisioning will go some way towards mitigating the compression in the NIM.

Of course, the shorter term impact is of more immediate concern to investors. And once again we believe that the record low interest rate should play a significant role in mitigating the extent of bad debts and provisioning. During the GFC, the RBA’s official rate was set at around 6%. This is a long way from the 0.25% we have today and provides a significant buffer. This is likely to be the case especially for households/mortgages, where the lowest rates on record will mean that a much smaller percentage of loans will default. We anticipate that only a fraction of the estimated $200bn currently requesting loan deferrals will actually progress into default.

We need to also remember that APRA has been regulating the banks’ lending standards more diligently than in prior cycles. LMI is commonplace for high LVR loans. And importantly, we have seen no crash in property prices to date, which in part was due to the cooling that occurred prior to Covid-19. In fact, despite the panic, property prices actually rose ever so slightly in April.

This is not to say that the banks will have a smooth ride. Whereas household lending is seen as less of an issue than during the GFC, the sting in the tail is likely to be in the SME side. Regardless of how low rates are, if revenue drops below expenses, you no longer have a business! This is the major risk factor we see in our forecasting.

Combining all of the above we see that bad debts will peak in the second half of the 2020 calendar year, at somewhere around 60-80 basis points on an annualised basis. When we remember that banks entered this crisis with the strongest balance sheets on record (thanks to years of APRA prodding), we have some confidence that they will see out this downturn in reasonable shape. The current pricing is suggesting that the issues are more systemic or of longer duration. We believe that this is not the case; that Covid-19 will have a transient effect on book quality.

Bank share prices in the UK and Europe have languished for years in a low rate environment. Why couldn’t that happen here?

Like statistics, share prices can provide a very different picture depending on how they are framed. For example, if we were to consider the largest UK Bank HSBC (LSE:HSBA) 2 months ago, the share price was around £6 versus £4 today. The 2nd largest bank in Barclays (LSE:BARC) was north of £1.70 versus less than £1 today. So taking a snapshot at what is likely the bottom of the market, can paint an overly gloomy picture. I suspect that the returns over a ‘normalised’ period have not been so traumatic.

There are also clearly some factors that are unique to the British landscape that have contributed to their poor performance: Brexit, eurozone dysfunctionality, smaller average mortgage sizes and loan/currency scandals.

And it is worth remembering that the British banks were heavily exposed leading into the GFC and suffered accordingly. To the point where the UK Government was forced to bail out a number of the very largest institutions and became the major shareholder in the likes of Lloyds Bank and Royal Bank of Scotland. It has taken significant time to sort out this mess. By contrast, not a single dollar of public money was spent on Australian banks.

But whilst all of these factors have played a part in generating sub-standard returns, the most important dynamic that differentiates the UK landscape, is a notably higher level of competition.

In Australia, there are just over 50 banks, but less than 10 have any scale and the top 4 control around 60% of the market. In the UK there are over 300 banks. As outlined above, the economies of scale and oligopolistic structure of the Australian industry enables Australian banks to maintain higher levels of profitability.

How are we investing in the banking sector?

Despite our current positive view on the banking sector, we are not long term holders of bank stocks. Earnings are cyclical, regulatory oversight and costs continue to increase and as discussed above, there are real and tangible headwinds – some of which have structural elements.

Accordingly, over the decade our weightings have pivoted to close to 0 on numerous occasions. Indeed our funds have been consistently underweight the banking sector and ordinarily by a fair margin.

Our preferred approach is to acquire bank stocks for a ‘season’ – i.e. where we see that there is an excessive dislocation between the price and the underlying valuation. We believe that the current situation qualifies.

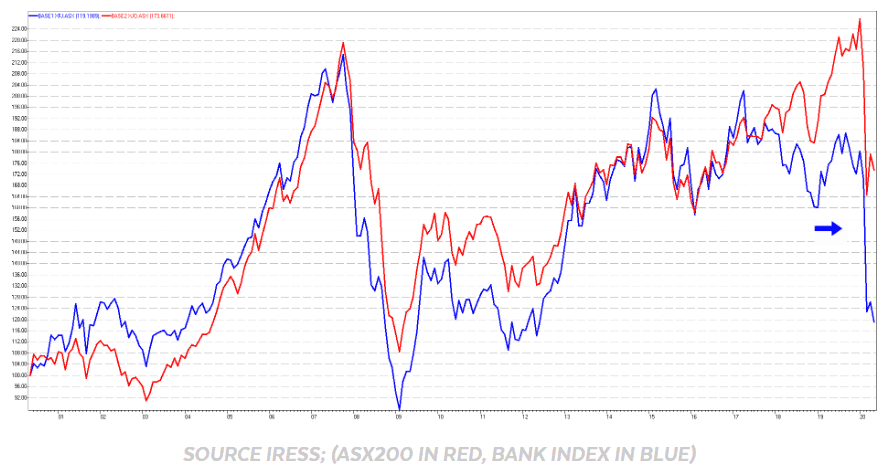

Indeed, the disconnect between the ASX 200 and the financials index is now at record levels.

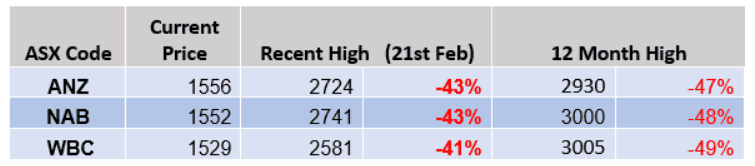

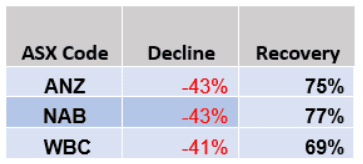

The current NAB and WBC share prices are below those of the GFC, and ANZ is barely in front. This seems incongruous given that the GFC was a crisis that arose out of poor bank lending practices.

In our assessment, these share price declines are excessive and seem to extrapolate the current uncertainty much further into the future than history would dictate.

Accordingly, we have significantly increased our holdings and are now sitting at close to market weighting at the sector level. We continue to hold cash reserves, and in our present state of mind would look to further increase our bank holdings if the sector was to further decline.

Our most recent purchases have focussed on the three majors (above), given their disproportionate declines relative to Commonwealth Bank of Australia (ASX:CBA). CBA is trading at a price to book value of 1.5x versus the other three big banks at an average price to book of 0.75x. CBA is a better business no doubt, but it’s not twice as good in our assessment.

There is also deep value present right across the spectrum including the regionals such as the Bendigo and Adelaide Bank (ASX:BEN) and Bank of Queensland (ASX:BOQ), which are trading at 49% and 50% discounts to their respective book values. From the current depressed levels, we would expect to make money on any stock in this sector; it’s really a question of how much and how quickly, not if.

With respect to the potential return, we need to remind ourselves that in a post-covid world, our country will have the lowest interest rates on record. The hunt for yield will be on in earnest. We, therefore, see no reason why the banks cannot regain their February 21 pricing over the next 18-24 months. This offers substantial capital growth from the current levels.

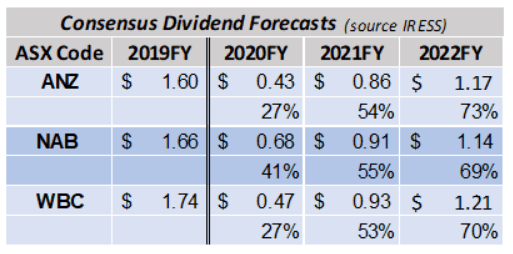

In addition, based on consensus forecasts, it is anticipated that these banks will be paying ~50% of their historical dividends in 2021 and 70% by 2022.

We believe that these numbers are (too) conservative and that the actual recovery will exceed current expectations. However due to the depressed share prices, even if dividends only recover at this pace, the average yield is knocking on the door of 6% fully franked this coming year moving to 8% fully franked thereafter.