Published on Australian Financial Review 13/05/2021 (Original Article Here, subscription required) – Sarah Turner

The strongest monthly rise in US core consumer prices in almost 40 years shattered investor complacency over the prospect of ongoing very low interest rates, and rang the bell on valuations in the interest rate sensitive technology sector.

US core consumer prices surged 0.9 per cent in April, the most since 1982, pounding global stockmarkets and reviving bond yields, as investors rapidly brought forward the expected timing of the first post-pandemic US Federal Reserve rate hike.

“I think it does change things for most people,” said Justin Tyler, founder of Daintree Capital. Ahead of the data, a sense of complacency had crept into the market over inflation, he said, and investors had only expected a little heat in the CPI over the coming months.

“No one thought that we would see anything quite this large,” he said. “This sort of data should, if anything, bring about some humility when we talk about markets.”

Headline CPI climbed 0.8 per cent in April, the most since 2009, for a 4.2 per cent annual increase to the most since 2008. Core CPI strips out volatile food and energy prices, and increased 3 per cent on a 12-month basis, the largest increase since 1996. Both measures far outpaced economist forecasts.

Sharp increases for prices of motor vehicles, transportation services and hotel accommodation came as businesses hit hardest in the COVID-19 pandemic re-opened and vaccinated Americans resumed social activities and travel.

While the data is for just one month and the rise in inflation may prove temporary as weak comparatives drop out and pandemic effects fade, the reaction across markets to the CPI data was savage and immediate.

US stocks crumbled, with the tech-heavy Nasdaq dropping 2.7 per cent while the S&P 500 index fell 2.1 per cent. The Dow fared a bit better with a 2 per cent slide.

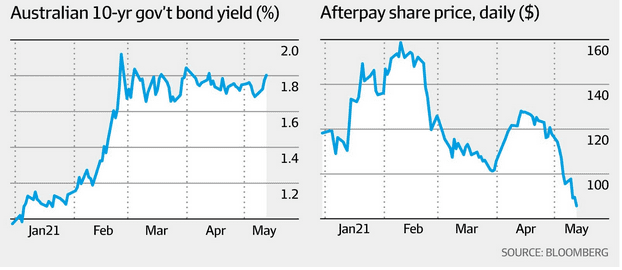

The losses spread from there: Australia’s S&P/ASX 200 dropped 1 per cent to a five-week low as technology stocks crumbled. Buy now, pay later darlings were hit hard as Afterpay dropped 5.4 per cent to $84.50 and Xero, which also reported results, slumped 13 per cent to $117.39.

“That April CPI number doesn’t say inflation is coming – it says inflation has arrived,” said Romano Sala Tenna, portfolio manager at Katana Asset Management. “We are starting to rebase our views on that and how quickly central banks are going to reposition and bring forward monetary policy.”

Bond yields rose as the prospect of Federal Reserve policy tightening – seemingly so distant at the depths of the pandemic – suddenly appeared a lot more likely. The US 10-year yield reached 1.68 per cent and Australian 10-year bond yields traded at 1.74 per cent.

Investors seeking protection from inflation fled to real assets including commodities, pushing iron ore to another record high. Currency traders sent the Australian dollar down to US77.12¢.

We haven’t had to worry about inflation for so long and the fiscal stimulus in the US certainly changed that.— Justin Tyler, Daintree Capital founder

National Australia Bank’s currency experts observed that futures markets have now priced in an 80 per cent chance of a rate hike from the Fed by the end of 2022 after the CPI data, worsening the discord between bond markets and the central bank.

FOMC members expect to sit tight on interest rates and have vowed to look through high inflation readings until they are assured that prices are sustainably above 2 per cent. The Fed funds rate is now zero to 0.25 per cent.

Australia’s Reserve Bank has made a similar commitment on monetary policy. The RBA has said that interest rates aren’t likely to rise from 0.1 per cent until at least 2024, when it hopes that inflation will be back in its 2 to 3 per cent target range.

But bond markets are sceptical that central banks can hold firm.

“There was always going to be a test of the Fed’s transitory narrative but I think that markets expected that test would be a longer time in coming,” said Mr Tyler. “We haven’t had to worry about inflation for so long and the fiscal stimulus in the US certainly changed that.”

Fed ‘behind the eight-ball’

The trillions of dollars pumped into the global economy by governments and monetary policymakers to counter the recession have succeeded in delivering stronger growth and higher inflation. But some investors are now worried that large amounts of ongoing stimulus in recovering economies will lead to inflation that will be hard to manage, and central bankers will be forced to slam the brakes.

Hedge fund manager Stanley Druckenmiller told CNBC this week that he struggled to understand why the Fed and other central banks haven’t already changed their policy settings to meet the rebound.

“We’re still acting like we’re in a black hole. In fact, the economy has accelerated,” Mr Druckenmiller said.

The role of the Fed is to take away the punchbowl before the party goes on for too long, said Hugh Giddy, large cap portfolio manager at Investors Mutual.

“I think inflation will rise very strongly if we keep on with interest rate policies and government over-stimulus and excessively low interest rates,” he said. “Inflation, as properly measured, would be already off the charts because people’s major purchase is a house and house prices are going up everywhere.”

The Fed is “behind the eight-ball”.

“I think they have old thinking in that. And [Wednesday, US time] was the first reality check,” said Mr Sala Tenna.

The investors who would suffer if rising interest rate expectations prompted another prolonged sharp rise in bond yields are those in the tech space or invested in other long-duration assets, said Mr Sala Tenna.

“The discount rate increases and future earnings look less attractive today in dollar terms. So, you know, earning a dollar 10 years out isn’t worth 90¢. It’s more like 50¢.”

On the other hand, producers benefited from higher inflation, and the banks benefited as well, he said.

“Basically, everything that’s running on the economic cycle should benefit because you’re getting some price appreciation. And the value stocks.”

Sarah Turner writes on markets and is based in our Sydney newsroom. Connect with Sarah on Twitter. Email Sarah at [email protected]