Published on LiveWire 11/05/2021 (Original Article Here, subscription required) – Romano Sala Tenna

Right here, right now – the biggest themes driving markets are electrification and decarbonisation – which are really two sides of the same coin. And with the global resolve now clearly past the inflection point, these themes are likely to be the dominant drivers for most of this decade.

So far, in an effort to gain exposure, Aussie investors have stumbled from graphite to cobalt to lithium to nickel and then back to lithium again. However, there is an emerging viewpoint that copper could be the surest way to gain exposure to the enormous electrification opportunity. For example, Goldman Sachs recently released a piece of research titled: Green Metals: Copper is the New Oil.

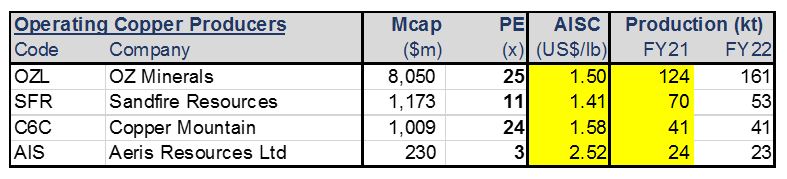

Given that the Australian market is renowned as one of 2 global resources hubs, it would be reasonable to assume that there would be a host of copper producers listed on the ASX. However that is not the case. If we exclude BHP and RIO – whose main earnings come from iron ore – there are only 4 ASX listed copper producers. Over the past decade, a combination of corporate activity, low copper price, increased fiscal discipline and depleted ore bodies has left us with just FOUR ASX listed copper producers. This is extraordinary for the most widely used base metal on our planet.

Of the 4 producers, OZL and C6C are both trading on PERs in the mid 20’s. SFR would appear superficially cheap, however the DeGrussa mine is scheduled to be depleted sometime during 2022.

This leaves Aeris, which our funds have been steadily accumulating on a PER of <3x.

Aeries recently came to life on the well-timed and equally well priced purchase of the Cracow gold mine from Evolution in 2020. In fact so well timed and priced was the acquisition, that in the space of 12 months they have been able to completely pay off their debt and are now generating strong surplus cashflow. But it is the Tritton Copper mine near Cobar in western NSW that has piqued our interest.

The Tritton mine has been producing copper since 2005. During this time it has produced over 320,000 tonnes of contained metal. Over the past decade, it has produced between 23,000 and 30,000 tonnes every year. It is forecast to produce around that amount – ~23,000t – this current financial year, at an AISC of $3.75 per lb. Yet despite this long term record, the stock is trading on a consensus average PER of 3x over 2021FY to 2023FY.

Clearly the market has concerns. From our analysis, there are 2 major investor issues: mine life and hedging.

Mine Life

The last stated reserve of 86kt contained metal equates to a little under 4 years. So on the surface this would appear an issue. However, there are important factors that make it highly likely that the mine will be operating for many years to come.

The first of these is highlighted by existing resources (as opposed to reserves). At 250,000 tonnes of contained copper, this is equates to more than 10 years at the current production rate. At the current high copper price, we would expect a solid and ongoing conversion of resources into reserves. But there is an even more important point. Reserve definition drilling requires a much higher level of saturation. Most mines of this nature drill the ore body to sustain mine plans (only) several years out. As the mine goes deeper, infill drilling of known resources will continue to add to reserves. The best demonstration of this is to review past reserve statements. In 2013, total Cu reserves were 126,000 tonnes. Since then the Tritton mine has produced nearly 190,000 tonnes and counting.

The second factor that adds to our confidence is that Aeris has reported strong exploration success over the past 12 months. In the coming years we are likely to see additional tonnes from 3 sources:

- Life of mine extensions via mineralisation at depth, South Wing, Budgerygar and the corridor between Tritton and Budgerygar

- Brownfields exploration at Murrawombie, where >5 metre intersections as high as 4% have been recorded

- Greenfields exploration via the Constellation target where the first drill hole spectacularly intersected 20m at 2.4% Cu.

It’s important to recognise that for much of the past decade, Aeris has been struggling with low Cu and gold prices and hence has not had the dollars to spend on exploration. This has changed in the past 12 months, and we would expect a steady stream of positive drill results.

Hedging

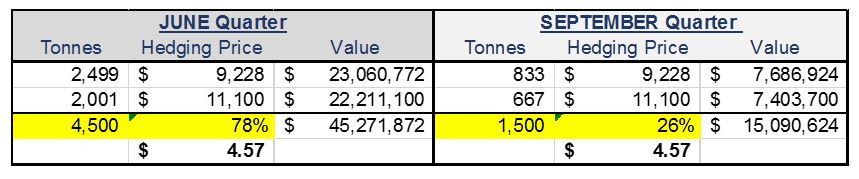

Like a lot of companies, when the Cu price rallied hard, Aeris prudently put in place some hedging in the event that the move faulted. Clearly in hindsight this has capped their short term benefit.

However the hedging currently in place is modest. Aeris has locked in 78% for the current quarter (which has only 7 weeks to run) and 26% for the September quarter, both at an average of $4.57 per pound.

This will still see a strong cash build, whilst also allowing the company to sell part production into the decade high price. Beyond the September quarter, Aeris is unhedged and will be able to sell 100% of its production at spot, which at the time of writing had pushed through $6.30 per pound.

Strong Risk-Return Proposition

If prices hold anywhere near the current level, this will see Aeris generate ‘super profits’. If the emerging consensus view is correct, then a combination of ‘super profits’ and limited cu producers may see investors clamour for stock.

On past earnings, a PER of 9x would equate to a share price north of 30c. If we flow through the current spot price for copper, then the ‘theoretical’ valuation is multiples thereof. If the market is being overly cautious, then this is a rare opportunity in a sector that has the strongest of tailwinds.