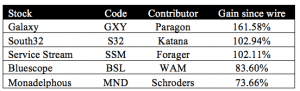

| The biggest mover on this list, and indeed among all stocks on the ASX 200, was lithium producer Galaxy Resources. John Deniz, MD of Paragon Funds Management told Livewire on the 29th Feb in this video interview in reference to Galaxy (and Orocobre): “You want to own large cap, world class, producing assets; you want to own imminent production. Despite rerating of the stocks, we still see strong risk-reward to the upside”. John recently published his view on another emerging niche commodity developer, which is available here.

On South 32, Romano Sala Tenna from Katana Asset Management told James Marlay in a video interview the 4th of March: “We’ve added some shares in South 32 to the portfolio…we think we could possibly be moving a bit early, but often these moves can happen quite quickly, and we don’t mind having a bit of exposure ahead of the move.” The move was a substantial one for a large cap, and the stock is now amongst the 25 largest on the market.

Steve Johnson at Forager wrote on Livewire back on the 17th of Feb that Service Stream: ‘has been spewing out cash thanks to working capital improvements. This stock had a market cap of $60m a few years ago and has generated more than that in free cash flow in the past 12 months alone.’ Since then it has more than doubled, and has been the fifth best performer on the ASX300 this year.

On the 12th Feb, Wilson Asset Management published a wire called ‘Bluescope Steels the show’ that BSL upgraded its profit forecast for the six months through December to $230 million, up from prior guidance of $180 million. Since then it’s up 86%. Following this big move, it’s worth noting that more recently BSL got a ‘Sell’ from John Murray of Perennial, and a ‘Hold’ from Vince Pezzullo of Perpetual, in a December episode of Buy Hold Sell.

On Monadelphous, Schroders published a wire around 12 months ago: “…we have been tilting the portfolio in recent periods to sectors and therein companies where we see pockets of mispricing, where vagaries of human emotion are overriding logic and value. For example we recently initiated a material position in Monadelphous” |