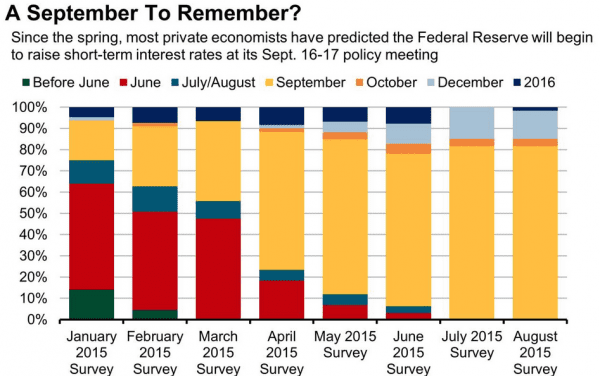

The Wall Street Journal’s August Economic Survey shows 82% of respondents expect the US to raise rates in September for the first time since 2006 (chart).

Romano Sala Tenna from Katana Asset Management says notwithstanding some volatility the early part of a tightening cycle is often a positive for equities. “If history is any guide the first four to six rate rises are not bad for equity markets, they’re actually quite good. It’s an indication the economy is strong and there is the capacity to raise rates. So that is a positive. Where the rates start to have an impact is where they get to the level where on a comparative basis it starts to make more sense to have your money in the bank rather than in bank shares.”

In this video Romano outlines one company he likes for a tightening US rates cycle and shares his views on whether there is still value in ‘USD earners’ (VIEW LINK).