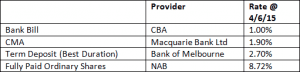

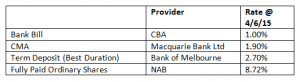

Keep it simple – sir! Without wishing to belie our 100+ years of combined experience (read combined mistakes), it would appear that Mr Market is throwing us a fat pitch with the recent pullback in the bank index. As an example we are anticipating that NAB will pay $2- even fully franked in the 2016FY (note consensus dps of $1.96). At $32.75 this equates to a grossed up yield of 8.72% – 600+ basis points above cash alternatives, with the potential for ‘special’ dividends as non-performing assets are ex-communicated. Another way to look at it is that the NAB share price would need to fall to below $30.79 to be worse off than holding the best alternative. By the 2nd year, this works even more in our favour; ie the NAB share price would need to decline to below $28.79 to once again be worse off and below $27.42 to generate a negative return. Of course this is possible, but the odds appear stacked in our favour. And we may even experience additional returns in the form of capital gains!