Article by David Rogers – Markets Editor, Sydney

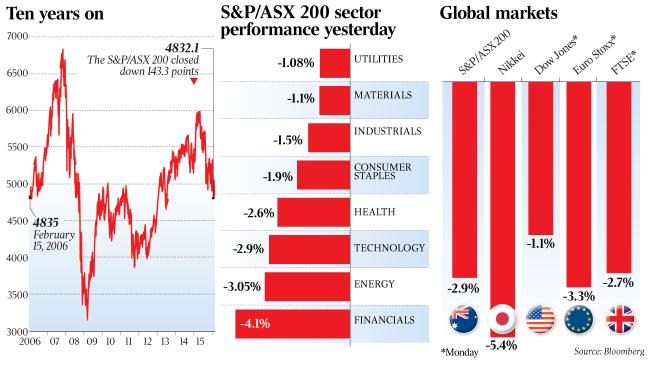

The local sharemarket lost almost $41 billion yesterday in its biggest one-day drop since September, with financial and energy stocks leading broad-based falls.

The slump came amid a global rout as corporate default risk soared on concern about a sluggish global economic outlook and slumping asset prices after the start of US interest rate hikes and fears of hard landing in China.

Ahead of Commonwealth Bank’s annual results today, the benchmark S&P/ASX 200 index dived 2.9 per cent to 4832.1 points.

That leaves the local market perilously close to hitting fresh 2½-year lows.

CBA fell 4.6 per cent, Westpac lost 5.2 per cent and National Australia Bank lost 4.8 per cent, while Bank of Queensland fell 8 per cent after warning of pressure on margins.

In the resources sector, Santos slumped 5 per cent, BHP Billiton fell 2 per cent and Rio Tinto lost 1.2 per cent.

The trigger for the renewed slump in equities was a surge in the cost of insuring corporate bonds after Deutsche Bank and Chesapeake Energy were forced to defend themselves over questions about their solvency. Deutsche Bank shares dived 9.5 per cent in offshore trading overnight.

The sell-off was worse in Tokyo yesterday, with Japan’s Nikkei 225 index slumping 5.4 per cent as a flight to safety pushed the Japanese yen up to its highest level against the US dollar since late 2014, while Japanese government bond yields turned negative for the first time ever.

With most of Asia remaining closed for the Lunar New Year holidays, Australia and Japan bore the brunt of the sell-off.

In commodity markets, spot gold hit a seven-month high of $US1200.97 per ounce, while US West Texas crude oil futures fell 3.9 per cent to $US29.69 a barrel before an expected rise in US inventories data.

The Australian dollar remained above US70c after the Reserve Bank left the cash rate at a record low of 2 per cent last week, still well above most comparable rates offshore.

Having fallen 19.2 per cent from its 2015 peak near 6000 points, the Australian sharemarket was back to levels prevailing in early 2006. It was also on the cusp of following China, Japan and Europe into a bear market — defined as a fall of at least 20 per cent from a major peak.

Investors were increasingly concerned that the disastrous start to 2016 could be a harbinger of global recession — widely seen as a necessary precondition for a sustained bear market in equities.

“Investors are rushing for safe-haven assets,” said Katana Asset Management portfolio manager Romano Sala Tenna, whose funds are holding 45 per cent in cash.

“A lot of the policy tools that were used to solve the last global financial crisis are exhausted, yet we still have the problems of high debt and sluggish economic growth.”

Australian 10-year Commonwealth Government bond yields fell 18 basis points to a 10-month low of 2.41 per cent following similar moves in global bond markets.

While business confidence remained steady last month, according to National Australia Bank’s Monthly Business Survey, it remained below the long-run average, underscoring the fragility of the Australian economy to external shocks. “There are competing factors at play here, with reasonably good domestic fundamentals helping to offset what could potentially be a big drag on confidence from global markets,” NAB’s chief economist Alan Oster said.

“Business conditions in mining have deteriorated to an eye watering -47 points, which is having a clear flow-on effect to conditions in the major mining states.”

While the chair of the Federal Reserve, Janet Yellen, is due to testify before the US Senate banking committee on Wednesday and Thursday this week, fund managers doubted she could say anything to reassure financial markets because they had already priced out any further US rate hike this year.

“Negative feedback loops are accelerating, so each time we see some monetary levers being implemented — such as Japan’s recent move to negative interest rates — it’s having less and less impact in terms of quantum and duration,” Mr Sala Tenna said.

“We are at a key turning point since the GFC where the market is losing confidence in central banks … the US Fed’s recent tightening seemed premature … and now the market is starting to question the ability of the European Central Bank and the Bank of Japan to resolve this.”

The challenge to stability in global financial markets could generate a formal response from the G20 Central Bank Governors and Finance Ministers when they meet in Shanghai this month.

“Rising risks of current financial market volatility feeding back negatively to the global economy raises the probability of a response from the G20 in Shanghai in late February,” said Gavin Friend, senior fixed income, currencies and commodities market strategist at NAB.

Article published by the Australian – 10th February, 2016