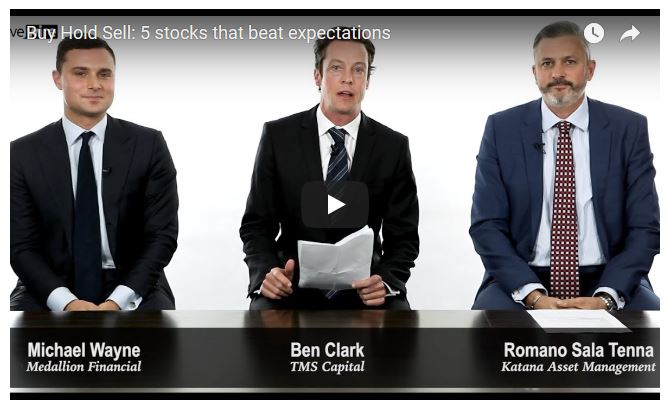

Published on Livewire 17/08/2018 (Original Article Here) – Romano Sala Tenna (Katana Asset Management – an Australian Fund Manager)

Results for some of the biggest stocks on the ASX have started to drop and a few have delivered above expectations. While the immediate pop on the day is like a sugar hit for investors, evidence shows this outperformance can extend for months to follow.

In this episode of Buy Hold Sell, we’ve picked out three big names that beat expectations. CBA’s result provided welcome relief for bruised investors, Magellan rallied 14% on news of a bumper dividend, and Crown’s strong numbers saw shares pop 6%. Ben Clark from TMS Capital asks Romano Sala Tenna from Katana and Michael Wayne from Medallion for their views on these stocks and asks them each to nominate a standout result that caught their eye.

Commonwealth Bank (ASX: CBA)

Romano Sala Tenna: HOLD. Leading in, the expectations were so low for the whole banking sector and especially Comm Bank, it’s all about reading sentiment in our mind. We think we’re past peak bad news flow. The odds are okay, credit grade’s okay, they’re trading at about a 30% discount the long term average. For us it’s a hold.

Michael Wayne: SELL. Along with the rest of the banking space. Although the numbers are better than expected, the key metrics of net profit, revenue, net interest margins, return on equity are all in decline, and it’s hard to see things improving in the immediate term.

Over the last 30 years, we’ve had interest rates come down consecutive year after year. We’ve had a big explosion in credit. Housing prices have gone through the roof. We’re now up against a completely different scenario, and I think the banks are going to have to transition their mentality away from a sales focus to a more compliance and risk management focus. It’s very difficult to maintain business momentum when you’re going through those changes. It’s a sell for us although, high quality organisation, the metrics aren’t moving in the right direction.

Magellan Financial Group (ASX: MFG)

Michael: HOLD. It’s our preferred pick in the diversified financial space, but you have to think of the global environment at the moment. Equity markets are again, mid to late cycle. We’ve already seen a de-rating of PEs for the diversified financial space as bond yields move high, and interest rates move high globally. For us, we just feel as though the market has appreciated a very good result, but there are some headwinds out there into the future.

But there’s no denying that we like the business dynamics for these sorts of companies. Very scalable businesses. As funds under management increase, your management fees increase. Your performance fees potentially increase. They’re very favourable with metrics that we like, but just given the recent run up in price, it’s a hold.

Romano: BUY. The numbers were 10% ahead of consensus. I think the kick on the day was really largely due to the dividend, and that’s a bit of a sugar hit because you had 99% payout ratio, you haven’t got much room to move these, so I think that’s one thing. But looking beyond that, with fund management we keep it really simple. We follow the flows and Magellan’s grown their FUM from 65 to 70 billion over the period. A lot of it was good margin sticky retail money, so for us it’s a buy, and we’ll continue to buy that until we see the FUM reverse. When we see the FUM reversed, we’ll reconsider our position.

Crown (ASX: CWN)

Romano: HOLD. It was a really good result. I’d like to see them put more money into buybacks. There’s worse things I can do than throw 400 million dollars into buying back shares. That’s a good thing. The yield’s good, balance sheet’s good, got tier 1 assets. A lot to like. They are trading at a 30% premium to Star Entertainment Group though, so for us, that sort of pulls it back and puts it in the hold category.

Michael: HOLD. Very good quality assets, very high-quality business, but we just think that things are a bit mixed at the moment particularly with the domestic operations which now makes up 95% of earnings. We saw very good result out of Melbourne. Perth continues to struggle, although the economy over in Perth is slowly recovering and that should help things. But focusing on the VIP Gaming, we did see a big bounce back in VIP Gaming. However, what drives that we think, comes from what’s going on in China. At the moment, we’re seeing a depreciation in the Renminbi, we’re seeing that the property markets start to cool in China, and we think that will affect the VIP Gaming, so we’re happy to hold it because they’re very good business, but we just think there are few headwinds challenging their growth profile looking at one, two years.

The Panel’s Picks

CSL Limited (ASX: CSL)

Michael: CSL again delivered a very strong result across all of the key metrics. Margins are expected to continue to expand. The blood plasma business, their core business continues to thrive in a space that at the moment is very challenged globally. But, CSL’s size, history, scale has enabled them to thrive in that environment, win even more market share.

It does look expensive by traditional PE metrics for instance, however you have to take into account that they account for their research and development straight away rather than spreading it out over the years. It actually makes their earnings or depresses their earnings somewhat. We think that this business is actually looking a lot healthier on the value metrics considering its growth profile than many people give it credit for. That’s another one we can happily buy even at these high levels.

Mineral Resources (ASX: MIN)

Romano: Mineral Resources . It was a modest beat this year, but if you look at analyst’s numbers one, two years out, we think it’s going to be a huge beat. If you sit here today thinking, “Where do I invest the next 12 months?” That’s the one for us. If you take a quick step back, in 2007, they listed at 38 million-dollar EBITDA. They’ve just announced 507 million-dollar EBITDA just over a decade on. On our numbers and our internal modelling we’re forecasting a 20% uplift in EBITDA this year, and then a 55% uplift the following year as Lithium Hydroxide comes in to production. If you are sitting here today