Published in AFR by Sarah Turner – AFR 4/11/19 (Original Source Link Here)

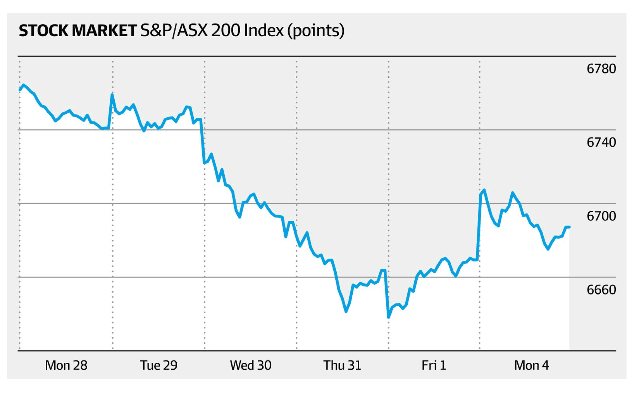

Investors pushed the market to a small gain at the start of the week, although steep losses from the banking sector kept the advance in check.

The S&P/ASX 200 index rose 17 points, or 0.3 per cent, to 6686.90 during the session.

Fresh record highs on Wall Street late last week set the stage for a solid session in Australia, after US investors cheered solid monthly jobs numbers.

Data undershot forecasts in Australia, however, with monthly retail sales only managing to grow at half the expected rate in September.

The 0.2 per cent advance was “probably a bit soft given that we have had stimulus,” said Romano Sala Tenna, fund manager at Katana Asset Management. “What it might be is that savings are increasing. People could be taking income and paying down debt.”

Banks performed poorly after Westpac said that it would raise $2.5 billion in fresh equity capital, reported a 15 per cent plunge in full-year net profit, and slashed its second-half dividend,

Westpac CEO Brian Hartzer called the year “disappointing” while highlighting that a weaker economy and record low interest rates were behind the result.

Westpac shares went into a trading halt at $27.88 but Australia and New Zealand Banking Group fell 0.9 per cent to $25.95, Commonwealth Bank declined 1.5 per cent to $77.05 and National Australia Bank dropped 2.5 per cent to $27.69.

Sala Tenna said that National Australia Bank’s capital position is most closely aligned with Westpac’s and investors are likely wondering if NAB will need to raise capital as well.

Still, Mr Tenna said that, having been very underweight on banks to date, he’s viewing the capital raising from Westpac as a good chance to buy back into the sector.

The fund manager has a broad view that the market is in the throes of a “reluctant rally” where investors are compelled to buy stocks such as the banks for yield. “Where else can they go,” he asked.

Resources catch a tailwind

Offsetting the banking sector losses, miners performed well during the session. BHP shares jumped 2.2 per cent to $36.48, Rio Tinto climbed 3.5 per cent to $96.69 and Fortescue Metals Group rallied 4.2 per cent to $9.38.

“Resources are catching a bit of a tailwind today,” he said, while adding “we’re a bit cautious.” Iron ore is a “bit directionless,” he said. However, supply and demand trends are starting to line up in the oil and sector, he said, adding that he believes “shale is near the peak.”

Panoramic Resources shot up almost 27 per cent to 42¢ after Independence Group lobbed an off-market takeover offer for the Western Australian nickel miner, offering one of its shares for every 13 Panoramic shares.

The offer implies a value of 47.6 cents per share, or $312 million, at a 40 per cent premium to its Friday close of 34c. Independence Group shares dipped 0.8 per cent to $6.35.

NRW Holdings rallied 13.3 per cent to $2.55 after confirming that it is poised to acquired Perth-based mining and construction contract BGC Contracting.

Consumer electronics retailer JB Hi-Fi fell 2.2 per cent to $35.83 after the retail sales data.

Goldman Sachs Australian equity strategist Matthew Ross said the evidence of a consumer recovery remained mixed. “While consumer-related stocks have outperformed through this period, the macro data remains patchy.”Advertisement

“Given the recent outperformance of consumer names, we see increased risk that the market has got too optimistic about the prospects of a consumer recovery.”

Building products supplier CSR advanced 9.5 per cent, extending a 4.6 per cent rise on Friday when the building products firm released its half-year results.

Credit Corp shares climbed 3.2 per cent to $32.34 after the firm flagged increased demand and grew new customer lending volumes by 18 per cent in 2019 compared to the previous year.

It returned to purchasing growth at core Australian and New Zealand debt buying operations late in 2019 “and there are signs that this trend may continue”.