Published on Livewire 24/08/2018 (Original Article Here) – Romano Sala Tenna (Katana Asset Management – an Australian Fund Manager)

S32 boasts the best balance sheet of any big-cap resource stock globally, and we continue to believe that the discount to its peer group is unwarranted. The shares traded noticeably weaker leading up to the reporting date, and while this is always a cautionary signal, we held the view that S32 represented an attractive investment.

This is particularly so given its:

•Sizeable cash reserves and strong cash generation

•Suite of low cost, long-life tier 1 assets

•30% discount to BHP.

Importantly, we are now also seeing the emergence of a portfolio of growth options. In addition to Arizona Mining and the Eagle Downs metallurgical project, S32 has established a further 18 exploration partnerships for greenfield base metals projects. These are long-lead projects, but together with their increasing investment in Trilogy Metals, provide medium and long-term growth drivers.

3 Key Takeaways From Full Year Results

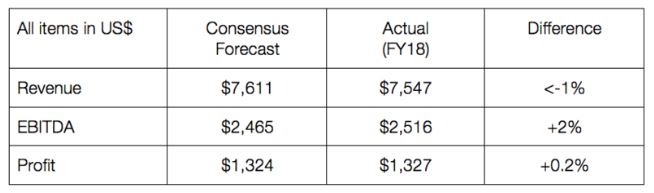

The result was perfectly in line with market expectations, as illustrated by these key metrics:

The extent of the Illawarra Metallurgical Coal deficit was surprising in terms of both production volume and unit costs. The latter in particular blew out from US$80/tonne to US$142/tonne, resulting in a loss of US$62m at the EBIT line versus +$358m in FY2017. Hence the most eye-catching aspect of the result was the ability for S32 to grow its profit by 16% in spite of the sizeable problems at Illawarra. This bodes well for FY2019 (see below).

The dividend was slightly below the pcp in US$ terms (slightly up in local currency terms) and the buyback was not added to, albeit there is still US$380m to run on the existing facility. This was a little surprising as although S32 has committed US$1.3bn to complete the buyout of Arizona Mining, they closed out the period with US$2bn net cash and generated US$1.4bn in free cashflow from operations. We therefore see scope for further special dividends/buybacks/acquisitions in the coming year.

Two Tailwinds Coming

We believe that the market is overlooking 2 potential drivers for S32.

The first of these is that there is a general disbelief that the current commodity spot prices will be maintained throughout the coming financial year. If we see manganese, alumina/aluminium, coal, nickel and the other base metals trading at the current levels, then we are likely to see a raft of earnings upgrades flow through.

Secondly, Illawarra Metallurgical Coal produced 5.7mt in 2017, generating $1,113m in revenue and an EBIT of $358m. This was achieved at an average price of US$175/tonne – well below the US$203/tonne average achieved in the 2018 FY.

S32 has provided guidance for an increase in metallurgical coal production in 2019 from 3,165t tonnes to 4,900 tonnes, and a reduction in unit costs from US$142/tonne to US$105. The company has also indicated that production is forecast to further increase by 900t tonnes to 5,800t tonnes in the 2020FY. Both of these numbers seem conservative given that it simply restores production to the level attained in 2017.

Nonetheless, if the company does manage to increase this production as planned, then this alone may provide ~10% profit growth in each of the coming 2 years. For a company trading on <10x earnings, this looks too cheap and may result in some PER expansion as investors recognise the growth potential.