Published on FE Investment Centre by Anastasia Santoreneos – FE Investment Centre 8/8/18 (Original Source Link Here)

Money Management, using FE Analytics, has looked at the funds in the ACS Equity – Australia sector that have outperformed the ASX 200 and maintained a lower FE Risk Score, which determines risk as a measure of volatility relative to the index.

Over the three years to last year end, the five best-performing funds have maintained a risk score of between 90 and 97, as opposed to the index which has a risk score of 100, and outperformed the index by over four per cent.

The SGH Australia Plus fund returned 19.56 per cent for the period and maintained a FE Risk score of 90, making it the lowest-risk, highest-performing fund in the Australian equities sector.

Also maintaining a risk score beneath the ASX 200 was Macquarie Australian Shares and Active Plus Equities funds with returns of 18.86 per cent and 16.37 per cent, respectively.

The Macquarie Wholesale Australian Equities fund also maintained an FE risk score of 97 with 15.12 per cent returns, while the Macquarie Australian Equities fund had a risk score of 96 and returns of 14.86 per cent.

The table below shows the performance of the top ten highest-performing funds over the three years to last year end with a risk score of below 100.

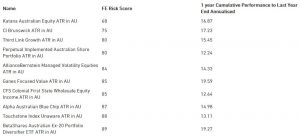

For the year to last year end, the Katana Australian Equity fund held the lowest FE risk score whilst still outperforming the index. It returned 16.87 per cent as opposed to the index’s returns of 11.80 per cent and held a risk score of 68.

CI Brunswick had the second-lowest risk sore at 75 and returned 17.23 per cent, also well above the index.

Of the top ten low-risk funds, the highest performer was the Ganes Focused Value fund with returns of 19.59 per cent and a risk score of 85, followed by BetaShares’ Australian Ex-20 Portfolio Diversifier, which returned 19.27 per cent and had a risk score of 89.

The table below shows the performance of the top ten lowest-risk funds over the year to last year end.