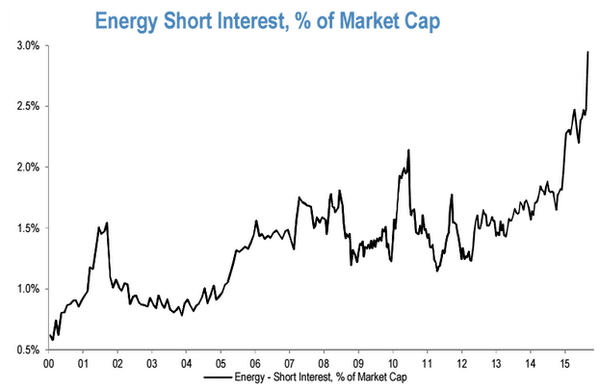

The graph below courtesy of JPMorgan relays an interesting message: US hedge funds have recently added to their short positions in the energy sector, despite the fact that the market has already experienced a pronounced decline.

It is likely that many of these funds are playing the ‘macro-call’ – ie anticipating further or sustained weakness in the oil price. However equally important is the fact that US listed energy companies are particularly exposed to high cost shale production. And as one commentator noted recently, shale’s ‘dirty little secret’ is starting to get out; being that shale production is a round robin with very little cash produced even at substantially higher oil prices.

In Australia, Santos leads the way with close on 10% of its capital now shorted – one of the 20 most shorted stocks on the ASX. Whilst we are not prepared to call the bottom in the oil price just yet, this confluence of large short positions and rapidly declining shale production, do set the scene for a rapid recovery in energy stock prices when confidence finally returns.